By Crosswise News Think Tank Research

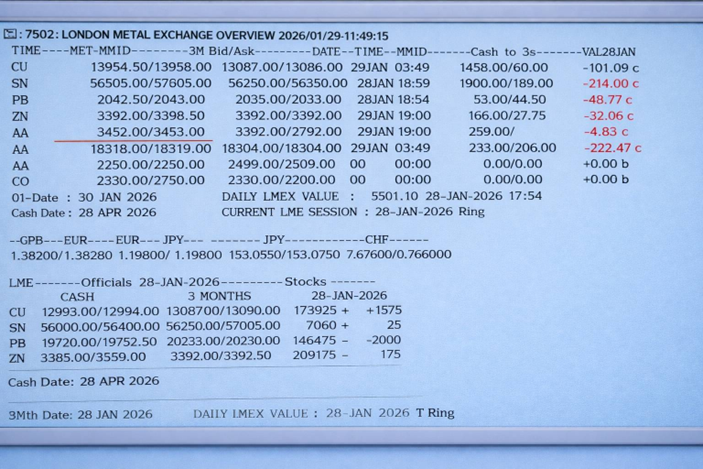

According to the latest trading data from the London Metal Exchange (LME), the copper market is experiencing rare structural distortions. The backwardation between spot prices and three-month futures has exceeded $1,000 per tonne, indicating unusually tight short-term supply conditions. However, analysis suggests that the recent surge in copper prices is no longer primarily driven by physical manufacturing demand, but rather by capital flows and financial trading squeeze dynamics.

- Key Copper End-Use Sectors: Energy, Electric Vehicles, and AI Driving the Demand Narrative

Copper is a critical base metal for global manufacturing and technology industries, with demand concentrated in three core sectors.

Power and Energy Infrastructure Copper is indispensable in power transmission and energy transition applications, widely used in high-voltage grids, transformers, wind power, and solar cables. Policy initiatives such as the EU’s Fit for 55 and the US Inflation Reduction Act (IRA) have significantly increased investments in power grids and renewable energy, forming a long-term policy-driven demand foundation for copper.

Electric Vehicles and Automotive Electronics Electric vehicles use two to four times more copper than traditional internal combustion engine vehicles, including in electric motors, high-voltage wiring harnesses, and charging infrastructure. As global EV penetration rises, automotive copper demand remains one of the most stable long-term growth drivers.

AI and Data Centers AI servers, high-performance computing clusters, and data centers with high-density power systems are significantly increasing demand for high-purity copper. The market widely views AI infrastructure build-out as a new structural demand narrative for copper, making it a key investment theme driving financial capital into the market.

However, as copper prices continue to rise, manufacturers have begun delaying procurement, reducing inventories, and even substituting copper with aluminum and other materials, creating a reverse cycle in which higher prices lead to lower physical demand.

- Financial Trading Desks Dominate the Spot Market

When backwardation exceeds $1,000 per tonne, it typically goes beyond what can be explained by pure industrial demand. Such extreme backwardation structures are usually driven by financial market squeeze dynamics, including:

Large international trading houses、Hedge funds、Commodity ETFs and macro asset allocation institutions、Chinese arbitrage capital and cross-market arbitrage trading

These capital forces use warehousing and cash-and-carry arbitrage strategies to push spot prices higher, creating a classic financial squeeze and causing prices to deviate significantly from physical supply-and-demand fundamentals in the short term.

- High Copper Prices Suppress Manufacturing Demand, Decoupling Prices from the Real Economy

High copper prices have placed significant pressure on global manufacturing. When spot premiums expand rapidly, end-user industries typically adopt the following strategies:

Delaying procurement and orders、Reducing inventories、Seeking substitutes such as aluminum、Suspending or postponing investment plans

This phenomenon, where higher prices lead to weaker demand, indicates a structural decoupling between copper prices and real physical demand.

- Forward Curve Severely Distorted as the Market Approaches the Peak of Financial Squeeze

The LME forward curve is a core indicator of commodity market structure. Generally:

Healthy industrial demand markets show mild backwardation

Financial squeeze markets show extreme backwardation

Bubble peak phases see backwardation collapse and shift into contango

Current market data suggests that the copper market is approaching the peak of a financial squeeze phase, with forward curve distortions significantly exceeding historical norms, indicating accumulating structural risks.

- Three Major Warning Signals Raising Market Concerns

- Backwardation Expands While Inventories Increas In a normal industrial demand market, expanding backwardation typically coincides with declining inventories. However, inventories are now increasing at the margin, indicating that metal is flowing into financial warehouses rather than end-user consumption—this is a classic structural pattern of commodity bubbles.

- Three-Month Futures Prices Have Not Risen in Tandem

Spot prices have surged, but three-month futures have increased only modestly, indicating that the market is not optimistic about long-term demand and that current price action mainly reflects short-term financial squeeze dynamics rather than fundamental improvements.

- LME Base Metals Index Has Not Made New Highs

The LME base metals index has not broken higher, suggesting that the supercycle narrative for base metals is losing momentum. Copper’s price rally is increasingly driven by short-term capital flows rather than broad-based growth in real metal consumption.

- Potential Market Scenarios Ahead

Backwardation Collapse Triggering Price Correction (Most Likely Scenario)

When the financial squeeze ends and spot premiums disappear, fund liquidations and reverse arbitrage by trading houses could be triggered. Copper prices could experience a rapid correction, with potential declines of 20% to 40%.

Think Tank Conclusion: Copper Has Entered a Financial Asset Phase

Comprehensive analysis indicates that the copper market is currently in a typical financialization cycle, where financial capital dominates price formation and real physical demand is suppressed by high prices. Copper has transformed from a traditional industrial metal into a macro asset allocation tool and a strategic technology resource price indicator.

Extreme backwardation combined with divergence in inventory structures signals that the copper market has entered a critical warning phase of a commodity bubble cycle.

Professional Quote for Publication

“Copper has evolved from a manufacturing raw material into a macro financial asset; when financial narratives diverge from physical demand, market volatility and systemic correction risks will rise simultaneously.”